As a single person you only have yourself to answer to when it comes to money and personal finances. But once you have a family things quickly become a lot more complicated. The money you earn may not be enough to cover all of your expenses which leaves you feeling quite upset at the end of every month. While you might be a saver, the rest of your family just spends and spends, and the next thing you know, your expenses are completely out of control.

When you have a family, saving money each and every day becomes extremely important. You never know when you might suddenly be out of work, or a family member may become ill.

In both cases you will need to rely on your savings to get you through.

As well you should always be saving money for your children’s education, as well as your own retirement.

The list of reasons as to why you should be building a savings account goes on and on, but how can a family build a savings account if they are finding that their current income barely covers their current expenses?

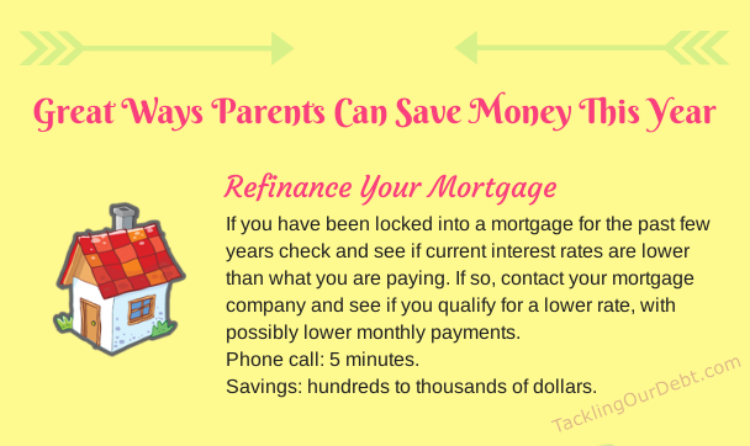

If you are tired of never having enough money, check out this infographic that I created for some excellent ideas on how parents can save money this year.

Make sure to get your whole family involved, and make sure that every dime you save goes into your savings account to help you fulfill all of your future financial needs.