Managing household expenses can be a daunting and stressful task. Do you feel like you’re doing all of the worrying about where your money is going? Feel like the only one in your house trying to spend smartly and stick to limited spending while your spouse spends at will? How can you change the way your spouse spends money so you can allocate funds back to your savings account?

Here are a few ways to get your spouse more involved and on the same page with the household finances! **Note that having knowledge of Microsoft Excel will be helpful with this exercise**

1. Understand Where the Money is Going

The two of you collectively need to get bank statements of your checking/savings account in monthly format going back to at least three months prior and analyze your spending.

Then create spending categories (i.e. Groceries, gas, credit card, dining out, phone, cable, utility, mortgage/rent, etc.).

From your total household income of the month, figure out what percentage of your income each category is costing you.

Do this at least three months back to help establish an average percentage for what you spend on each category.

This is how you establish a preliminary budget. Do that for each spending category.

Analyze each category.

For example, your utility bill is going to be higher in the winter months than it would be in the summer months.

2. Understand How Much Money is Coming In

The two of you collectively need to figure out how much money you have coming in. This is not just limited to your salary. This can be tax refunds, grants, gifts, or any other monies that you will put in an account and could be spent. Try to be month specific.

For example, if your tax refund comes in April, you would add that to your monthly salaries for April so your spending budgets would be a little larger that month.

On the other hand, February has fewer days which results in less money coming in, and your spending budgets would be smaller.

3. Create Categorical Budgets

Now that you’ve analyzed and know what percentages of your income are being spent on which categories, you can now establish preliminary budgets.

Using a spreadsheet or Microsoft Excel, you can create a household checkbook to track all of your expenses and have working budgets throughout the month so you know how much money you have left to spend on each category.

You may find that your preliminary budgets when added up are more than your income for that month.

This is where you would need to figure out where you need to cut spending.

Obviously, your fixed costs like the mortgage, car payments, etc. are things you can’t cut. But dining out, entertainment, etc., are the areas that you would need to reduce your budget in these areas to have a successful financial month.

This is what’s known as flexing your budgets.

4. Create a Budget “Checkbook”

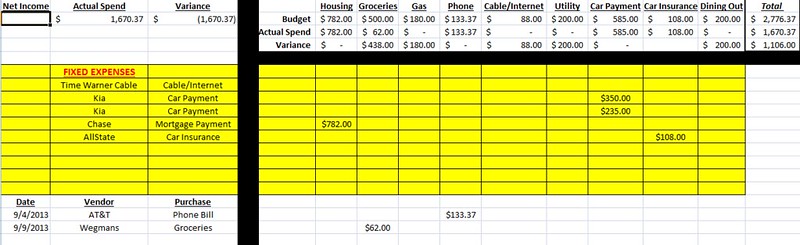

Now that you have figured out your preliminary budgets, spending categories, total household income, you are ready to build your Budget Checkbook. Using Microsoft Excel, you will create a functioning spreadsheet where once it’s built, you will just enter your expenses and the spreadsheet will do the rest. First you will need to set it up. Depicted below is an example of what it should look like:

As you can see, we established our spending categories running horizontally across the page.

We established our budgets for each category along with a line for or total spend per category as well as a line for our variance which tells us how much is left in the budget per category.

Note that we began the spreadsheet with our fixed expenses.

These are expenses that do not change from month to month and can be copied over month to month when creating new spreadsheets for each month. Then as you accumulate expenses, enter them in the section under the date, vendor, and purchase.

5. Set up the Cells

This is where your knowledge of Excel will come in handy. When looking at the actual spend line, you want each cell to automatically do the calculations for you. For example, you’re looking for your actual spend of grocery.

You need that cell to add up the contents of the grocery column. To do that, you would type in a simple formula: =sum(F7:F60). This will automatically add up everything in grocery column.

To find your variance, you simply put in a formula that subtracts your actual spend from your budget. So for example for housing, you would enter the following formula: =(E2-E3). Repeat these steps for each category.

With the steps above, you and your spouse can work together to eliminate stress of family finances. When both parties are involved, it will make a happier, more financially sound, household!